OLED vs Micro LED Technology Comparison in Display Engineering

In the rapidly evolving field of display technology, OLED (Organic Light Emitting Diode) and Micro LED stand as two of the most promising and revolutionary display technologies. Both deliver high-quality visual experiences but differ significantly in their construction, performance, longevity, and manufacturing complexity. This article provides an in-depth technical comparison of OLED and Micro LED technologies, utilizing industry data, performance parameters, and practical considerations to equip engineers and procurement specialists with a profound understanding essential for informed decision-making.

Fundamental Technology Differences

OLED displays utilize organic compounds that emit light when an electric current is applied. Each OLED pixel comprises organic layers sandwiched between cathode and anode electrodes, which glow individually, enabling perfect black levels through true pixel-level light emission control. According to the Society for Information Display (SID), OLED panels boast a contrast ratio exceeding 1,000,000:1, thanks to these self-emissive pixels (SID, 2022).

Conversely, Micro LED technology comprises millions of tiny inorganic LEDs, each acting as an individual pixel that emits light independently. Unlike OLEDs, Micro LEDs use inorganic semiconductor materials, such as gallium nitride (GaN), providing superior brightness and longevity. The U.S. Department of Energy's reports confirm that Micro LED displays can deliver more than 2,000 nits of brightness compared to OLEDs' typical 600-800 nits, making Micro LEDs ideal for high ambient light environments (DOE, 2023).

Display Performance Parameters

- Brightness and Contrast: Micro LED surpasses OLED in peak brightness, suitable for outdoor digital signage and environments with direct sunlight exposure. Meanwhile, OLED maintains unmatched contrast and near-perfect black levels due to its complete pixel shutdown, which Micro LED is approaching but not fully matching yet.

- Color Accuracy and Gamut: Both technologies provide exceptional RGB color performance. OLEDs typically cover 100% of DCI-P3 color space. Micro LEDs can potentially surpass this, reaching extended gamuts beyond DCI-P3, approaching Rec.2020 standards, largely owing to inorganic LED materials' stability and spectral purity.

- Response Time and Refresh Rates: OLED panels achieve sub-millisecond response times due to their organic emissive nature, ideal for high-frame-rate video and gaming displays. Micro LED, benefiting from direct LED emission, maintains similarly fast response times, although mass commercial applications are still emerging.

- Lifespan and Burn-in Resistance: One critical challenge for OLEDs is organic layer degradation, leading to burn-in and brightness decrease typically after 30,000 to 50,000 operational hours (based on multiple industry lifecycle tests). Micro LEDs boast significantly longer lifetimes, with inorganic LEDs capable of exceeding 100,000 hours without significant degradation.

Manufacturing Challenges and Cost

OLED manufacturing processes involve depositing organic layers via vacuum thermal evaporation (VTE) or inkjet printing on substrates such as flexible plastic, glass, or metal foil. While the processes have become mature, large-scale production of OLED displays remains expensive due to yield losses and material costs.

Micro LED manufacturing is more complex—each Micro LED must be individually fabricated and then transferred precisely onto backplanes, often through pick-and-place processes or mass transfer techniques. This complexity currently results in high costs and limited production scale. However, advancements such as wafer bonding and laser lift-off techniques are rapidly driving down costs and improving yields.

Applications and Market Trends

OLED has established dominance in smartphones, high-end TVs, and wearable devices due to its exceptional image quality and form-factor flexibility. According to IHS Markit, OLED shipments for smartphones exceeded 500 million units in 2023 alone.

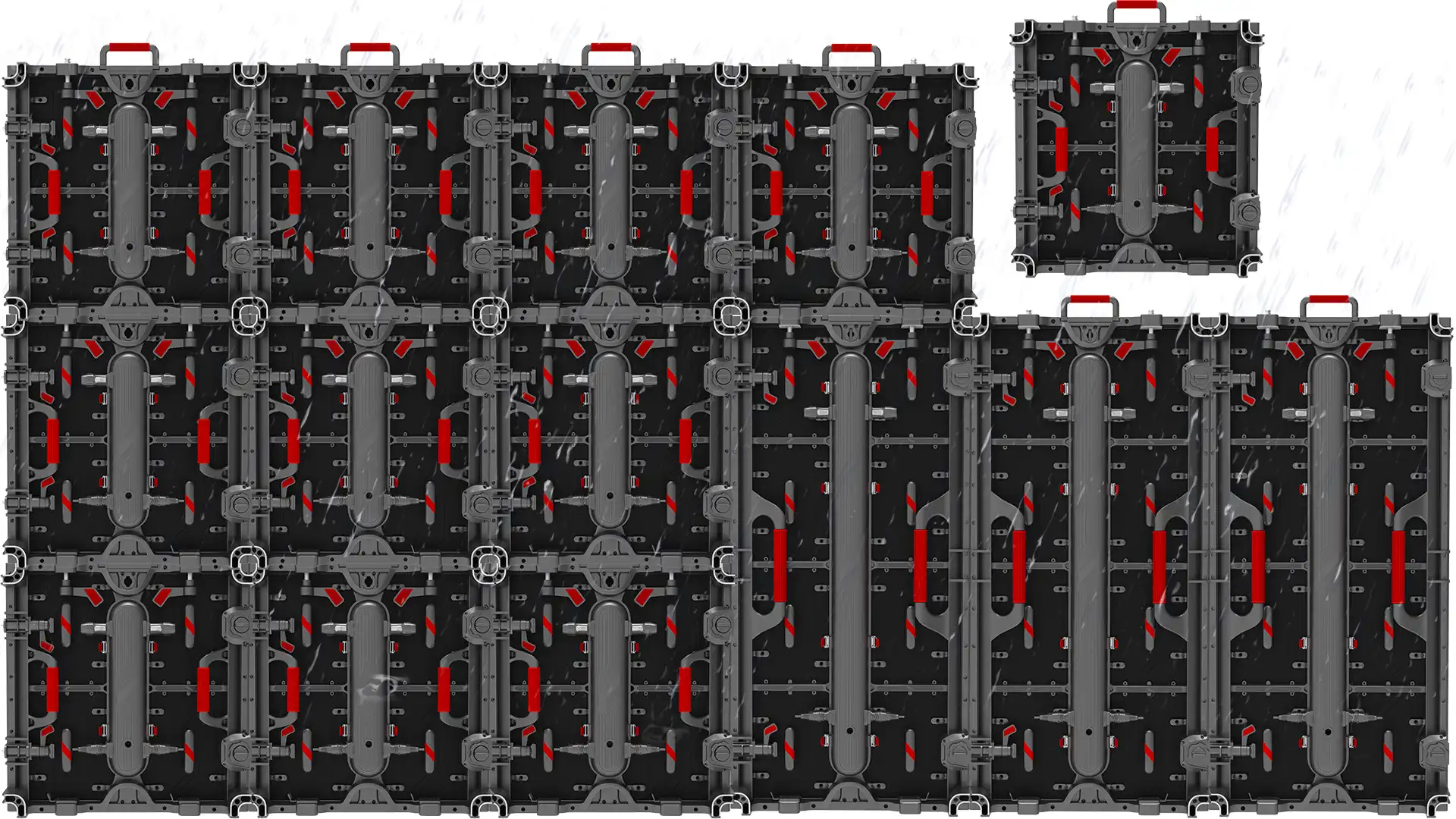

Micro LED, while still emerging, holds tremendous potential in large-format displays, AR/VR devices, and outdoor digital signage where brightness and durability are critical. Leading manufacturers such as Samsung and Sony have launched Micro LED-based modular TVs exceeding 100 inches diagonal, showcasing scalability and superior performance.

Conclusion

For display engineers and decision-makers, the choice between OLED and Micro LED depends on application-specific priorities:

- OLED excels in flexibility, color fidelity, and contrast, making it preferable for consumer electronics emphasizing image quality and thin form factors. The challenge remains to mitigate burn-in for prolonged use.

- Micro LED shines in brightness, lifespan, and durability, positioning it as the technology of choice for large displays, outdoor use, and commercial applications, though manufacturing complexities currently limit widespread adoption.

As Micro LED fabrication matures and economies of scale are achieved, it is poised to become a mainstream technology rivaling or even surpassing OLED in both consumer and professional markets. Staying abreast of these developments will be essential for industry professionals aiming to leverage the latest advancements for optimized display solutions.

References:

- Society for Information Display (SID). (2022). “OLED Display Technology Overview.”

- U.S. Department of Energy (DOE). (2023). “Solid-State Lighting Program: Micro LED Research Highlights.”

- IHS Markit. (2023). “Global OLED and Micro LED Market Forecasts and Trends.”

- Samsung Display Technical Whitepaper. (2023). “Advances in Micro LED Transfer Technology.”