The concentration of brands of LED Displays Industries Markets has increased

The LED display market in 2017 witnessed a strong performance by new three board businesses in the first half. LED downstream applications encompass display, backlighting, lighting, and other application boards. In 2016, the size of China's LED downstream application market reached 369.7 billion yuan, with the four application segments accounting for 12%, 11%, 66%, and 11% respectively. Statistics indicate that LED lighting holds the largest share among these downstream applications.

The LED display industry involves numerous enterprises, with LED lighting being just one of the downstream sectors. Notable players in this field include Yuanheng Photoelectric, Joint Hair, New Asia Wins, Foshan Qingsong, China United Optoelectronics Technology Co., Ltd., and Glory among others. Additionally, non-listed companies such as Shanghai Think Twice and Strong Giant Color should not be underestimated.

Currently, the listed company has fully disclosed its performance for the first half of the year. From an "interim results" perspective, Li Yad delivered a revenue of 2.121 billion and a net profit of 370 million, further widening the gap with other enterprises. Joint Photoelectric and State Science and Technology also demonstrated outstanding performance, surpassing the billion mark in the first half. Alto Electronics experienced doubled growth in both revenue and net profit. However, Abby and Lehman shares witnessed a decline in net profit.

From the first half results, the brand concentration in the LED display industry market is expected to further enhance. Major brands such as Li Yide, Lian Jian Optoelectronics, and Chau Ming Technology have witnessed consistent revenue growth, while some small and medium enterprises have faced increasing competition for market share. Additionally, it can be observed from the table that 10 companies have achieved revenue growth.

In the initial phase of LED display market growth, strong giant color has emerged as a prominent player, and with the deepening commercialization process of LED displays, high-density (small pitch) LED displays have become the primary driving force for growth. However, in the high-density segment, pricing remains opaque and commercialization still has a long way to go." The relevant spokesperson from Strong Giant Color stated, "Nevertheless, we are committed to advancing high-density technology by not only offering increasingly favorable prices but also introducing free DIY high-density products to reduce costs for users. This will undoubtedly shape future trends and contribute to further growth in the high-density sector.

The small gap on the LED display has prompted Shanghai to reconsider its identity in the market-driven role. With breakthroughs in core technology and high-definition display, as well as easy maintenance and other characteristics, it continuously expands its market applications. It has become an indispensable quality choice for security, corporate propaganda, radio and television, conference center shows, showcasing Shanghai's strong power in the LED display market. According to a relevant person in charge from Shanghai.

With the continuous improvement of LED display technology, the declining cost and increasing maturity of the product, the LED display industry is experiencing rapid development. According to data from GGII, a leading LED research institute, China's LED display industry output value is projected to reach 42 billion yuan in 2017. Furthermore, GGII predicts that by 2020, China's LED display industry output value will soar to 57.7 billion yuan.

The soaring raw material prices necessitate a strategic approach to address downstream pricing challenges.

The prices in the LED industry have caused significant disruptions, resembling a blockbuster. Recently, concerns over raw material prices have once again emerged, leading to continuous discussions about industry reshuffling and closures. For small and medium enterprises barely surviving on thin margins, these developments are disheartening. Now they fear being paralyzed by market fluctuations; their situation can be described as soldiers fighting against adverse conditions, but not without limits.

In the fiercely competitive market, LED display enterprises are faced with rising operating costs, forcing them to reluctantly adjust their prices in order to maintain reasonable profit margins. Regarding this pricing issue, Giant Color emphasizes that they do not need to pass on the increased raw material costs to customers. Instead, they focus on automating production processes and improving efficiency, as well as integrating high-quality supply chains through strategic cooperation within the industry. By doing so, they aim to create value for their customers.

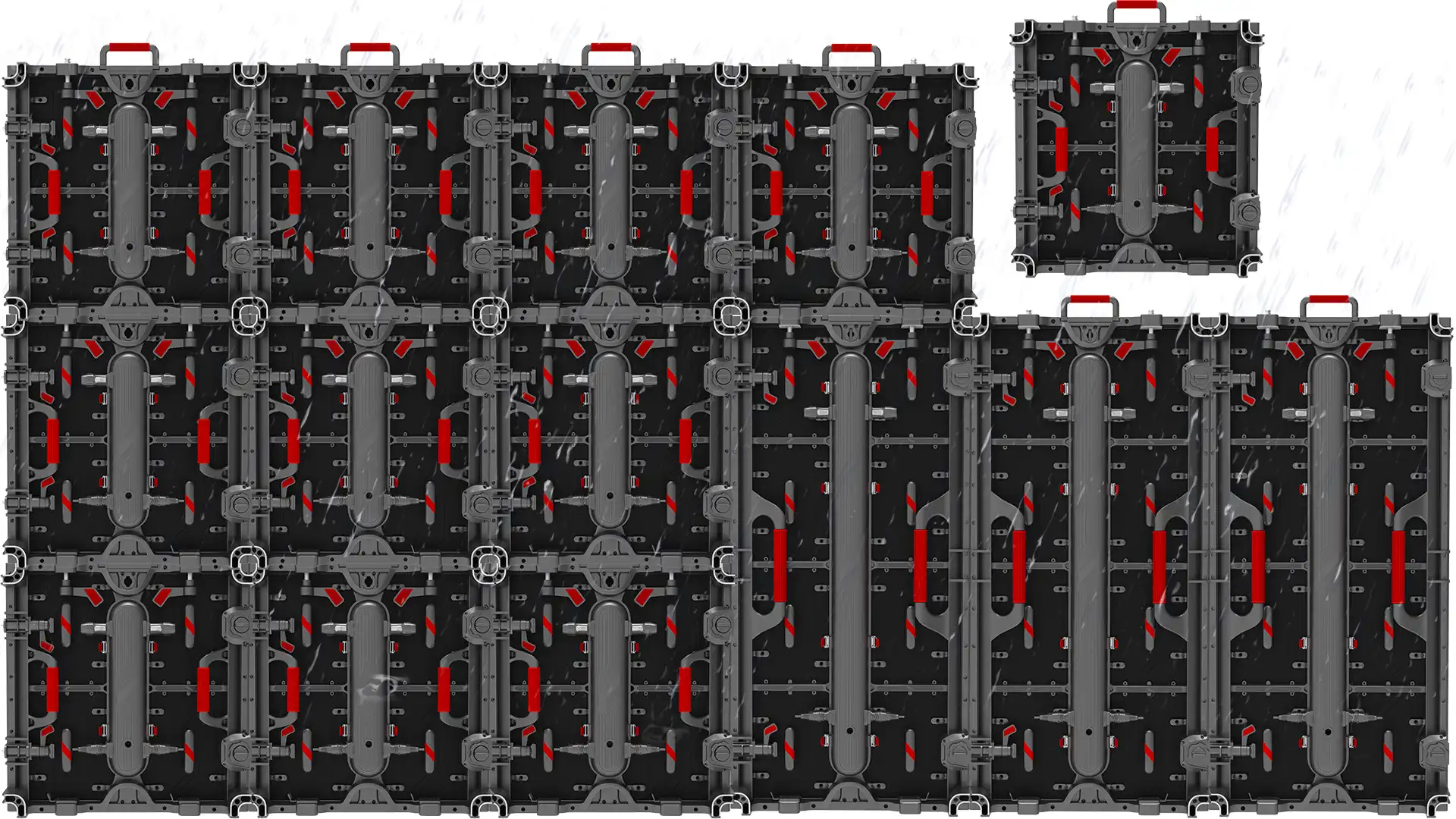

The manufacturing process of PCB boards, boxes, and other LED display accessories causes a certain level of pollution, which violates national environmental requirements. Therefore, rectification and industrial upgrading are necessary to indirectly improve the cost of these accessories. The continuous heat in the small pitch LED market has led to increased demand for multi-layer PCB boards, boxes, and other materials. Consequently, this has also resulted in higher prices for raw materials such as PCBs and boxes. "Senior LED experts from Shanghai suggest that manufacturers may attempt to gain market share by offering low-cost alternatives; however, this approach will ultimately be eliminated due to non-compliance with environmental regulations. It is crucial for LED manufacturers to handle this situation rationally and actively seek solutions.

OLED and MicroLED attack, LED face a huge challenge?

Despite the rapid development of solid-state lighting, the display backlight market for LED remains significant. These devices have been used to illuminate screens for over a decade, initially in traditional packages and more recently in chip-level packaging for LCD backlighting. However, due to factors such as cost and manufacturing feasibility, LEDs are currently not utilized as direct light-emitting elements at close distances - that is, pixels.

Due to this, in recent years, OLED (organic light-emitting diode) and MicroLED technologies have emerged, resulting in a vibrant display market. Particularly noteworthy is the intense competition among numerous domestic and international industry giants, with these three technologies poised to dominate the field of display.

The OLED display technology, characterized by self-luminosity, wide viewing angle, nearly infinite contrast ratio, low power consumption, and high response speed, has been increasingly pursued by manufacturers. On the other hand, MicroLED can utilize independent red, green and blue subpixels as controllable light sources to create displays with exceptional contrast ratio, rapid response time and expansive viewing angle.

The insiders believe that MicroLED displays are significantly superior to OLED counterparts due to their wider color gamut, higher brightness, lower power consumption, longer lifespan, greater durability, and improved environmental stability.

The dispute over LED, OLED, and MicroLED technologies prompts Shanghai to carefully consider their implications. In recent years, OLED and Micro LED have gained significant traction in development with numerous major companies investing efforts into them. Currently, OLED and Micro LED find more applications in small business screens and wearable devices rather than large splicing screens due to various technical challenges that need to be addressed. However, if the process issues related to Micro LED's utilization in large screens are resolved successfully, it cannot be ruled out as a strong competitor for LED big screens.

However, the prominent giant color holds a divergent perspective, stating that Micro LED remains a conceptual product with limited mass production capabilities and minimal competition at present. As for OLED, it is still in its nascent stage and lacks commercial viability, thus being far from achieving widespread popularity. Conversely, LED technology has essentially matured and commenced commercialization, making it the prevailing choice in today's market. In summary, while LEDs have gained popularity, both Micro LED and OLED have a long way to go.