2024 Display Industry Three trends For Micro LED, AR/VR and OLED Industries

The display industry in 2024 will witness three prominent trends, namely the integration of Micro LED technology, advancements in AR/VR, and the growth of OLED industries.

Recently, in response to the technological advancements in the industry, TrendForce, a renowned global market research organization, unveiled three significant trends projected for the display industry by 2024. These include Micro LED technology, AR/VR technology, and the OLED sector.

Trend 1: The influx of new entrepreneurs is increasing, and it is anticipated that the cost optimization of Micro LED technology will occur by 2024.

The year 2023 is a critical milestone for Micro LED as a display technology to achieve mass production, with the primary focus shifting towards resolving the challenge of high costs. In terms of chip development, efforts have been initiated to miniaturize the chips, aiming to replace the current mainstream large displays measuring 34x58um with smaller dimensions such as 20x40µm or even 16x27µm. It is anticipated that by solely implementing chip shrinkage, Micro LED chips can achieve an annual cost reduction of at least 20~25% over the next four years. Transfer plays a pivotal role in the manufacturing process of Micro LED. While stamp transfer offers stability, laser bonding excels in speed (Unit per Hour, UPH). However, now that mass production is underway, industry players are striving to strike a better balance between efficiency and yield. By adopting a hybrid transfer approach combining stamp transfer and laser bonding techniques, this innovative cold processing concept effectively addresses issues encountered during hot pressing in stamp transfer. Consequently, pressure and temperature concerns have transformed into an extensively discussed production model.

The micro-projection display market for AR transparent mirrors is a highly promising application market for Micro LED technology. Due to the stringent requirement of extremely high Pixel per Inch (PPI), the size must be controlled at 5µm or even smaller, posing challenges in achieving satisfactory external quantum efficiency (EQE) of accompanying chips. While using red, blue, and green LEDs provides a simple solution, overcoming the issue of low red light efficiency remains difficult. Alternatively, employing blue LEDs with quantum dot materials for color conversion effectively addresses these challenges but introduces additional complexities in terms of processes and material lifespan. Emerging start-ups are exploring unconventional approaches such as InGan-based red LEDs and RGB LED vertical stacks which have garnered attention. Although it is currently uncertain which technical route will become mainstream, this diversity fosters innovation towards finding the best solution. With increasing interest from manufacturers driven by component improvements, process optimization, abundant solutions, mass production capabilities, and diversified applications; more investments are expected in this field by 2024 while enhancing the supply chain and further optimizing Micro LED cost structure.

Trend 2: The development and competition of AR/VR in various micro-display technologies will intensify.

Driven by the demand for AR/VR and other head-mounted devices, there has been an increased demand for near-eye displays with ultra-high PPI. Micro OLED displays have emerged as one of the leading technologies in this field. Although only a few AR/VR devices currently utilize Micro OLED displays, their market potential is expected to expand gradually with the adoption by key brand customers. The future development of personalized displays will heavily rely on the integration of semiconductor processes and display technology, while various micro-display technologies like Micro LED are also continuously advancing. Currently, Micro OLED displays represent the pinnacle of semiconductor manufacturing processes and AMOLED evaporation processes. For manufacturers producing Micro OLED panels, securing stable wafer foundry resources will be crucial. Both new entrants and existing manufacturers are actively reorganizing industrial resources to meet this demand. Additionally, it is anticipated that matching OLED technology will transition from white light OLED to RGB OLED in due course. However, limitations in brightness and luminous efficiency still pose challenges for Micro OLED displays' mainstream adoption in head-mounted devices; thus further observation of each micro-display technology's development process is necessary.

Trend 3: The advancement of foldable mobile phone technology and the commercialization of new materials will drive further expansion of the OLED industry, enabling its application across a wide range of sizes.

After the successful innovation and market buzz generated by OLED folding mobile phones, the newly launched foldable devices have made significant improvements in line with consumer expectations. These include the replacement of lightweight composite materials in door panels and screen support panels, as well as the integration of water drop-shaped hinges. This structural enhancement effectively reduces the number of components and even utilizes the casing cover to replace the hinge keel, gradually approaching the thickness and weight of flat-screen devices. As foldable mobile phone adoption rates continue to rise, it becomes crucial not only to pursue continuous technological advancements but also to effectively reduce costs in order to ensure profitability while expanding market reach.

As the adoption of OLED technology in the mobile phone market continues to expand, it is becoming a crucial battleground for further development. In order to increase its presence in the existing IT market, panel manufacturers are taking strategic steps such as Samsung's investment plan to establish a new G8.7 factory, BOE's planned B16 facility, JDI's ongoing advancements in eLEAP technology, and Visionox's aggressive entry into the market with their OLED-related technologies. These initiatives not only cater to Apple's demand for medium-sized applications but also create new opportunities for OLED panels to penetrate other application markets. It is anticipated that post-2025 developments and introductions of new technologies will overcome size limitations imposed by FMM and evaporation machines. Additionally, with the commercialization of long-lasting materials and smooth integration of high-generation production lines into mass production, these advancements will significantly enhance OLED's penetration rate in future markets.

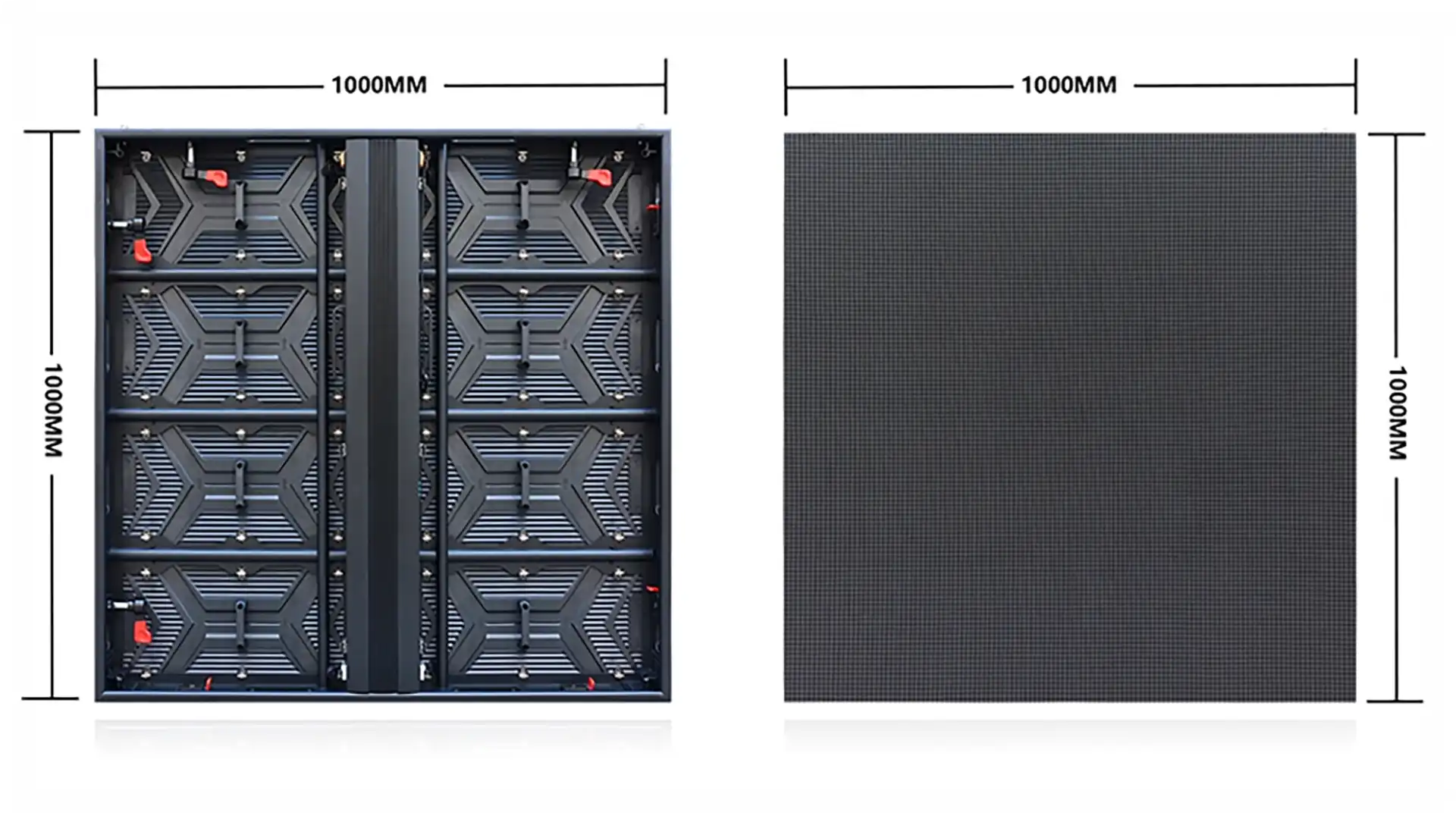

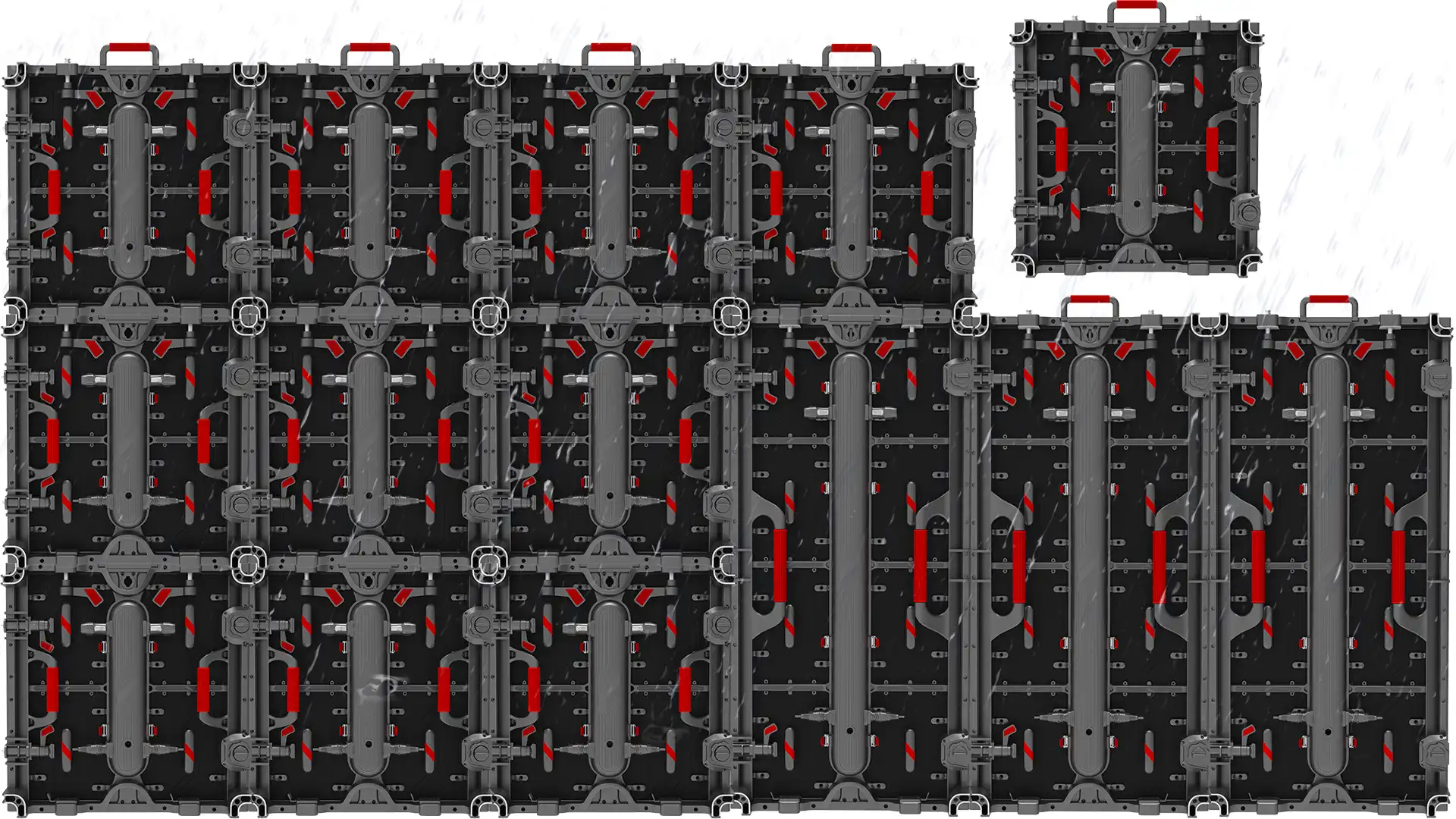

Links: COB Display | MIP Display | Indoor Display | LED Display Videos